Real-Time Portfolio Intelligence

Two integrated solutions that work together—or independently—to give you complete visibility into your portfolios.

Dolphin-Risk

Forward-looking risk analytics for multi-asset portfolios. Calculate VaR, run stress tests, and answer "what if" questions—in real-time, not overnight.

- VaR Analysis — Historical, Parametric, Component, Marginal, CVaR

- Stress Testing — Historical scenarios and custom shocks

- Sensitivity Analysis — PV01, DV01, CS01, Key Rate Duration

- What-If Analysis — Test trades before you execute

Total Portfolio View

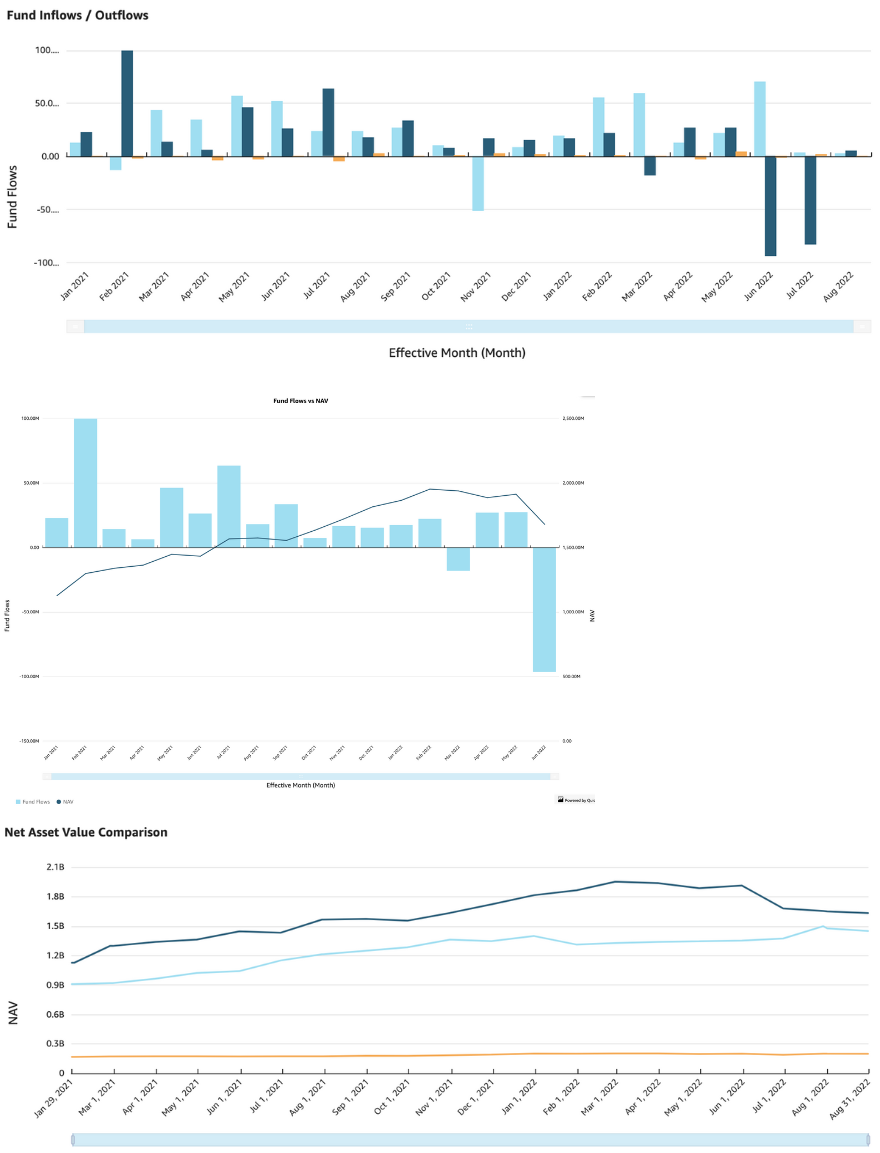

Unified visibility across holdings, risk, performance, and accounting—in a single BI-enabled platform. No more pulling data from five systems to answer one question.

- Holdings — Real-time positions, exposures, allocations

- Risk — Ex-ante and ex-post analytics integrated

- Performance — Returns and attribution in the same view

- BI Integration — Works with Tableau, Power BI, and more