Dolphin-Risk

Forward-looking risk analytics for multi-asset portfolios. Calculate VaR, run stress tests, and answer "what if" questions—in real-time, not overnight.

Forward-looking risk analytics for multi-asset portfolios. Calculate VaR, run stress tests, and answer "what if" questions—in real-time, not overnight.

Investors and managers demand access to portfolio data and real-time analysis. Yet most firms are stuck with backward-looking (ex-post) metrics that tell you what happened, not what could happen.

Conversations around 'risk' with clients are difficult—it needs to be explained in simple, easy-to-understand terms. Not just numbers, but what they mean in the portfolio's context.

On the institutional side, the challenge isn't whether risk capability exists—it's whether you have the technology to get answers to clients in real-time.

Traditional risk systems run overnight batch calculations. By morning, markets have moved. Dolphin-Risk changes that.

Run risk analytics on demand using current positions and live prices. No waiting for overnight batch runs.

See exactly how every number is calculated. Drill down from portfolio VaR to individual security contributions.

Connects to your existing IBOR/ABOR via API. Uses the same prices as your performance and accounting systems.

Click any capability to see details, screenshots, and demo videos.

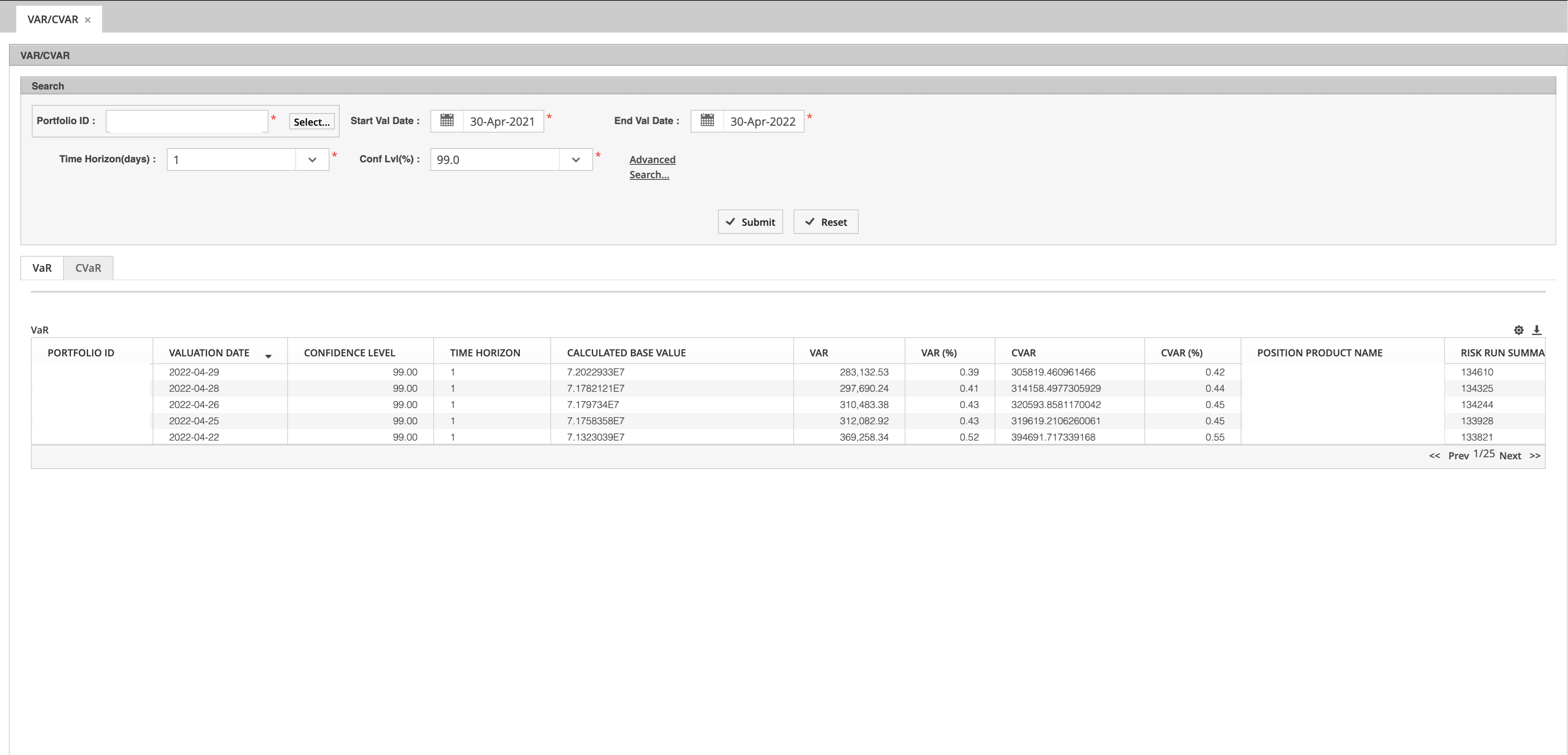

Estimate maximum potential loss at specified confidence levels using Historical Simulation VaR with full portfolio revaluation. Understand not just the number, but where the risk is coming from.

Validate your risk model by comparing historical VaR predictions to actual outcomes. Essential for model governance and regulatory compliance. Includes exception tracking and model accuracy statistics.

Set confidence level, time horizon, and sample size parameters.

Execute calculations and analyze CVaR, Component VaR, and attribution.

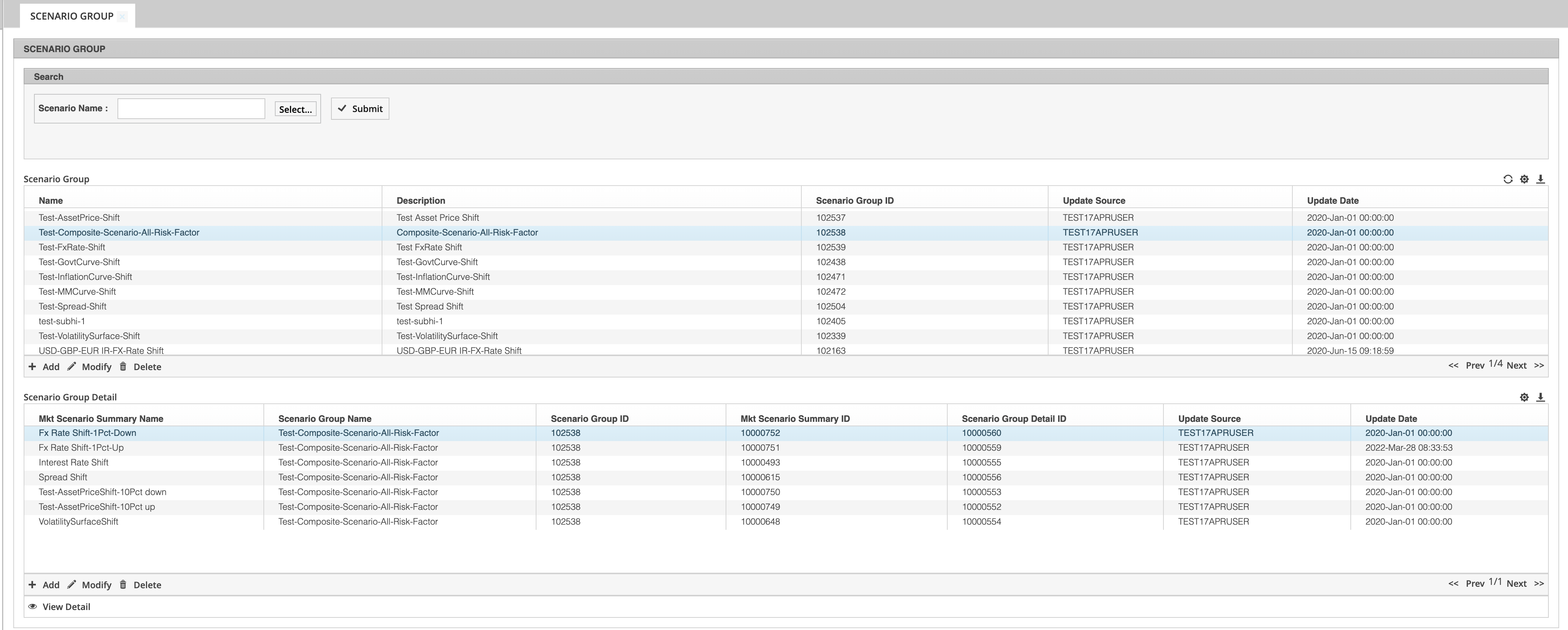

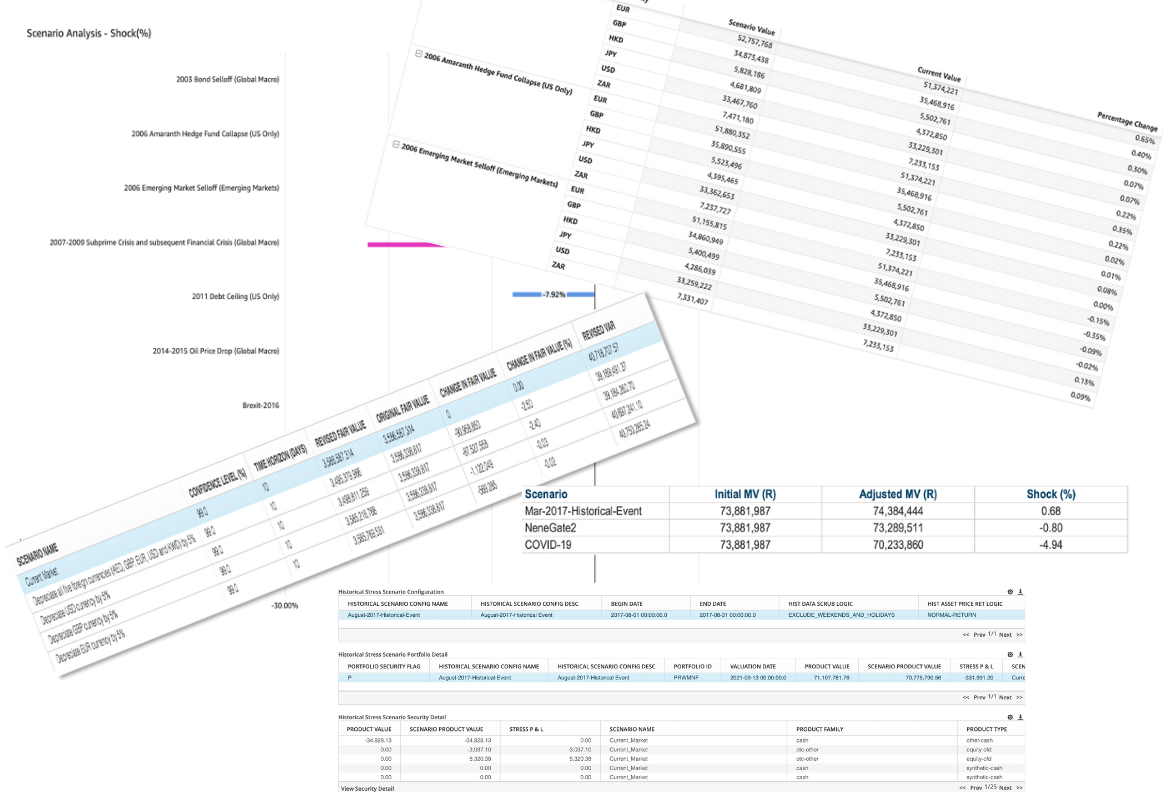

Analyze portfolio behavior under extreme market conditions with configurable factor shocks—interest rates, FX, credit spreads, asset prices, and volatility.

Set up factor shocks and see portfolio impact in real-time.

Replay historical market events to understand how your current portfolio would have performed. See the impact of past crises on today's positions.

Replay market events like COVID-19 or GFC on your current portfolio.

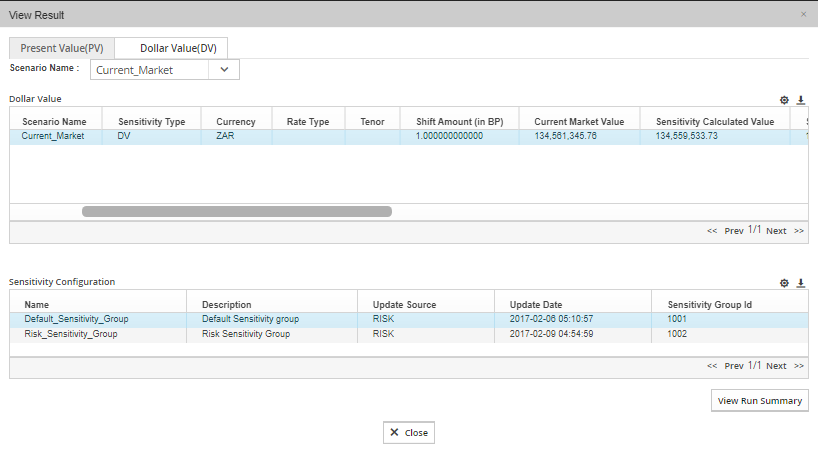

Measure portfolio sensitivity to changes in key risk factors with detailed key rate duration, PV01, DV01, and credit spread analysis across tenor buckets.

View PV01, DV01, CS01, and Key Rate Duration across tenor buckets.

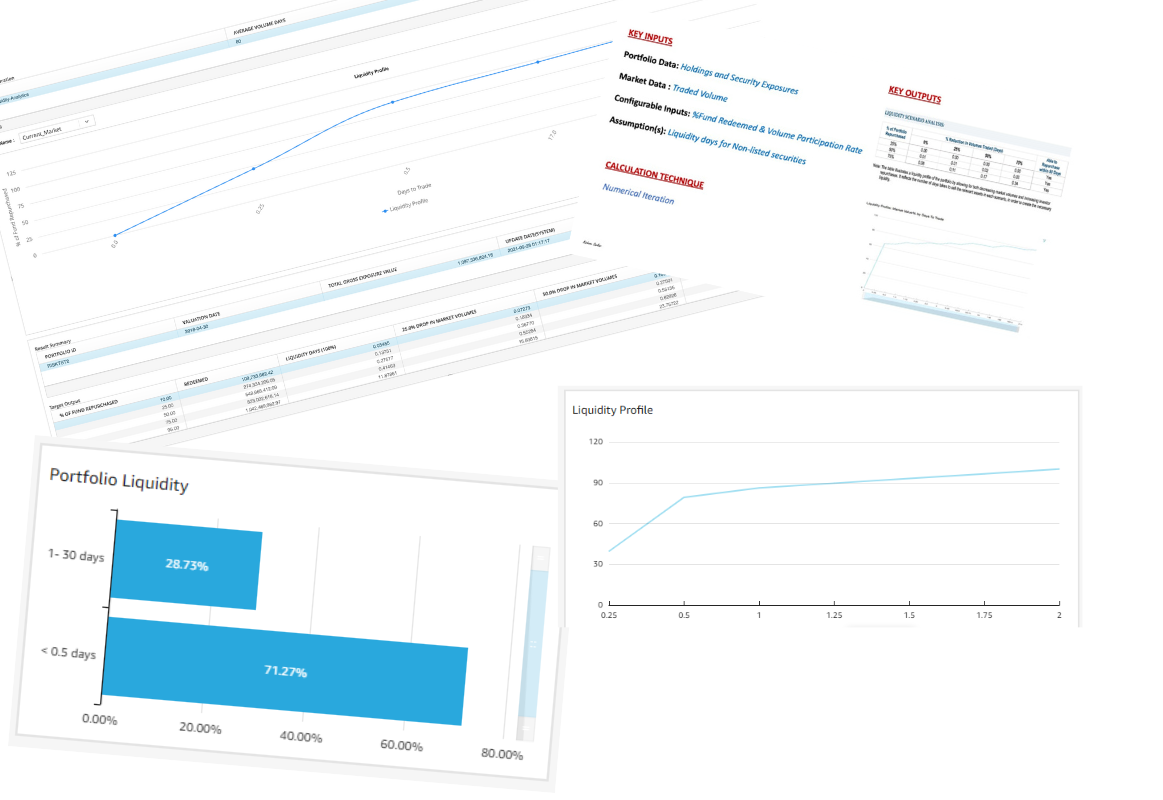

Understand how quickly positions can be liquidated and model redemption scenarios to ensure you can meet investor demands without significant market impact.

Set up analysis parameters and redemption scenarios.

Analyze days-to-liquidate and redemption scenario impacts.

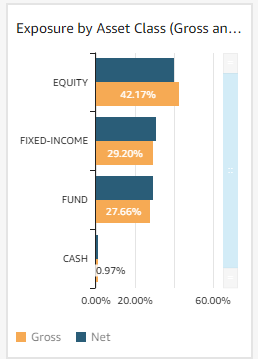

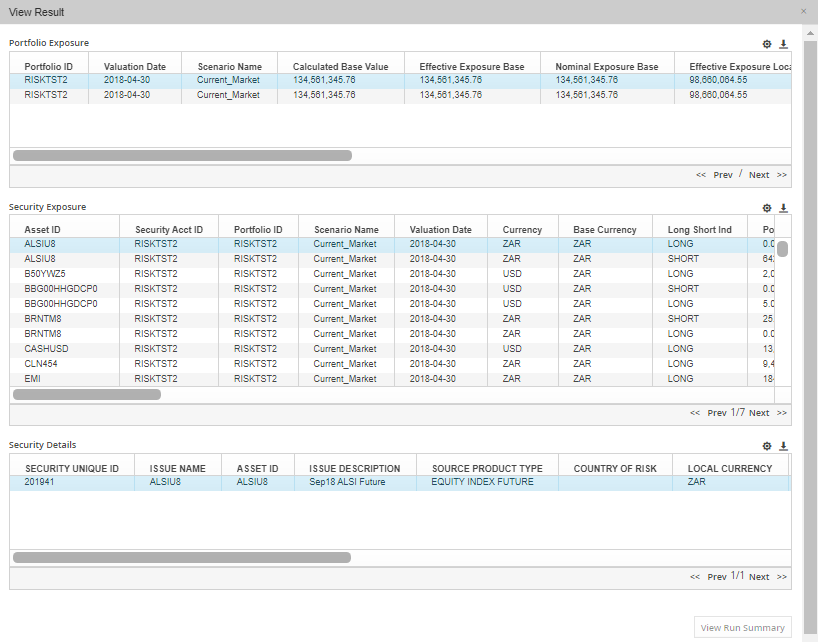

Understand your true portfolio exposure across asset classes, sectors, currencies, and geographies—including the real exposure created by derivatives.

View exposure by asset class, sector, geography, and currency.

Simulate the impact of trades before execution. See how adding or removing positions affects your portfolio's risk profile in real-time.

Understand how changes in interest rates affect your portfolio's future cash flows and overall economic value—critical for portfolios with floating rate exposure.

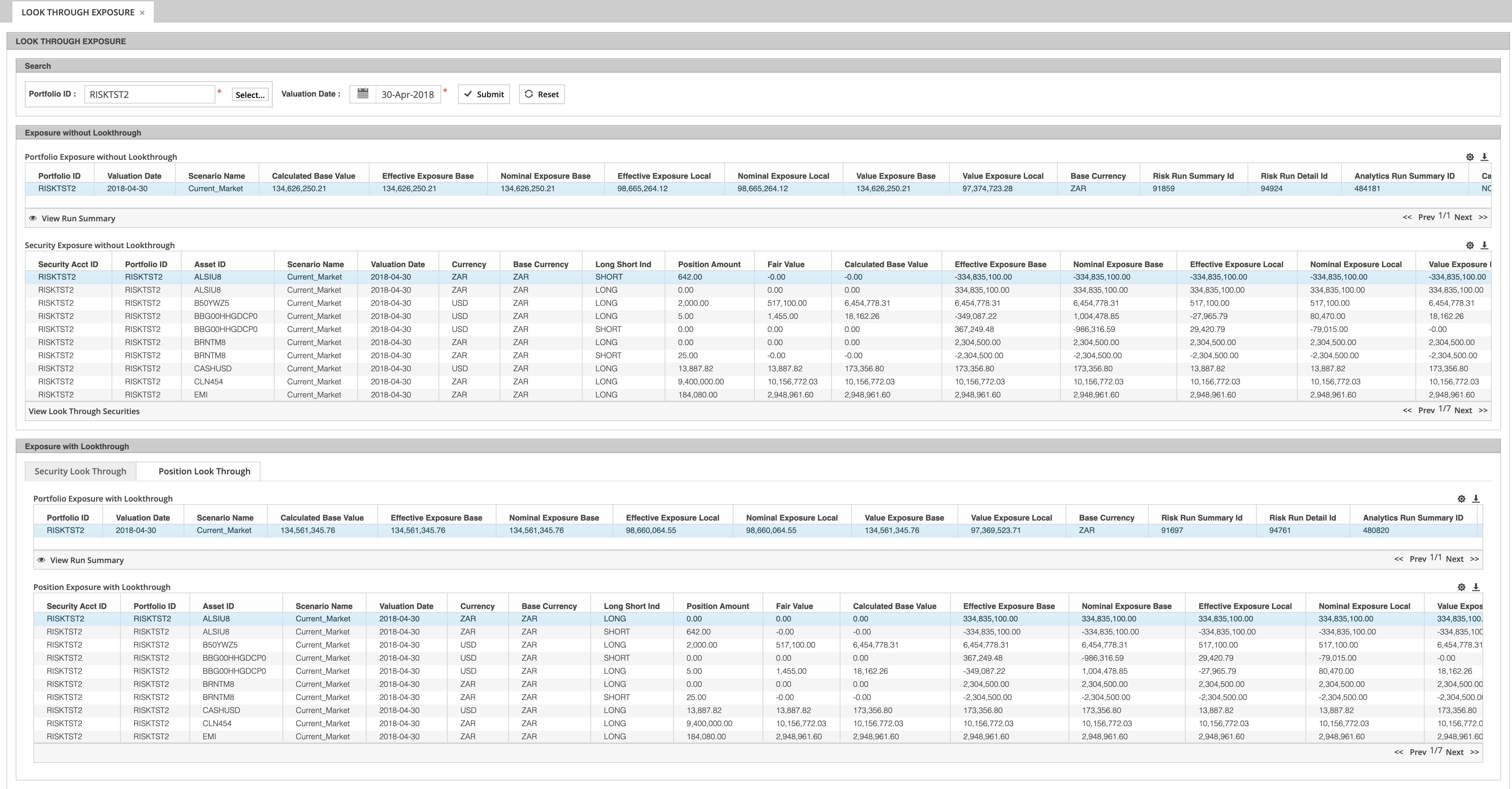

For portfolios containing funds, ETFs, or complex structures, see the actual underlying exposures—not just the wrapper.

Comprehensive analytics at the individual security level for fixed income and derivatives.

Security-level analytics available

for all supported instruments

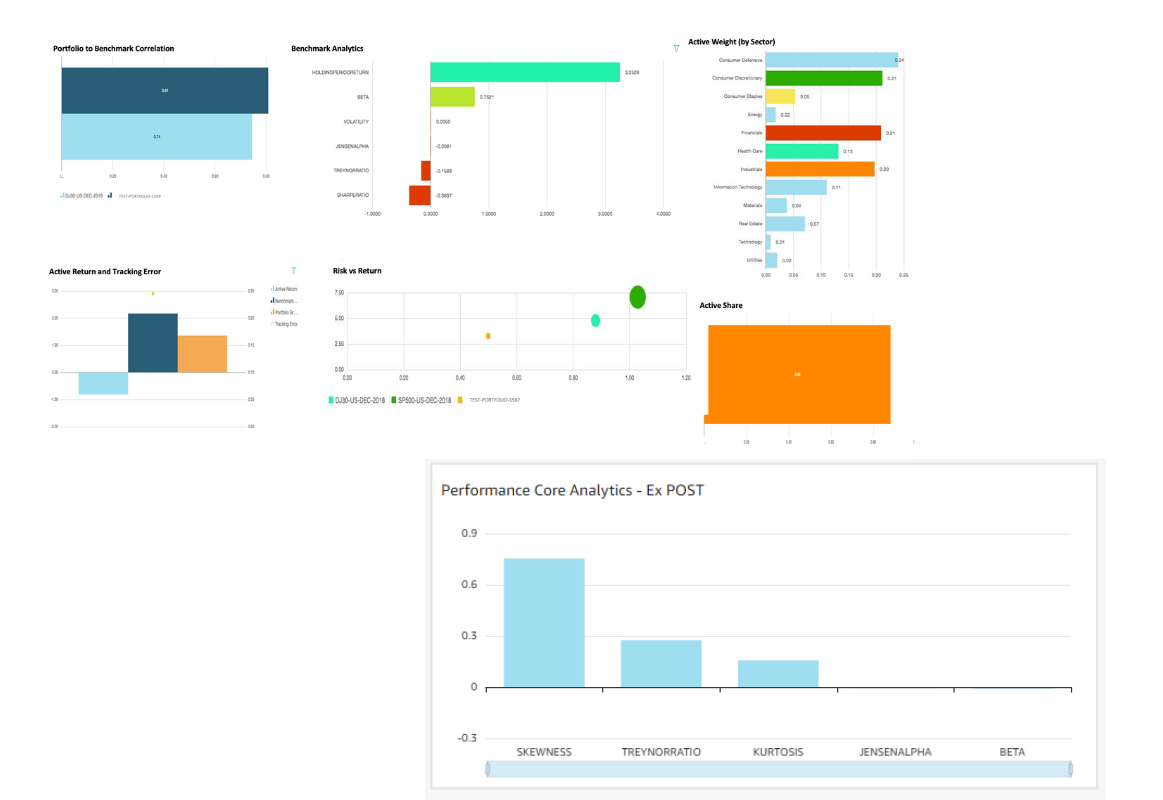

Backward-looking risk metrics for performance evaluation, attribution, and historical analysis.

Comprehensive backward-looking

risk and performance metrics

Tailor analytics and risk models to your specific needs.

Extend Dolphin-Risk with your own analytics:

Adapt risk models to your investment approach:

From vanilla equities to complex OTC derivatives and alternatives, Dolphin-Risk handles the instruments in your portfolio.

Dolphin-Risk integrates via API with your current infrastructure—no rip-and-replace required.

Pre-built integration enables 8-week implementation for BNY-Eagle clients using standard risk models.

REST API integration with any modern data management system. 8-16 weeks depending on number of instruments and data integration complexity.

Uses your existing market data sources (Bloomberg, Reuters, ICE) under your licenses.

Common questions about Dolphin-Risk portfolio analytics.

Using real-time APIs to get Holdings, Reference, and Market data from your existing data management system (IBOR/ABOR). We don't require batch file transfers—everything happens via API in real-time.

Yes. Integration of all necessary market data is through your existing data management system. The same data used for performance and accounting is used for calculating risk analytics—eliminating reconciliation issues. We can also integrate with Bloomberg, Reuters, or EDI sources if needed.

Because integration with your data management system uses APIs, users can make calculation requests through Dolphin's web interface or programmatically. Upon request, necessary input data is obtained from your systems and calculations are performed in real-time—no overnight batch processing required.

The platform includes comprehensive ex-ante analytics (VaR, CVaR, Stress Testing, Scenario Analysis, What-If Analysis, Liquidity Analytics, Sensitivity Analysis), ex-post metrics (Tracking Error, Sharpe Ratio, etc.), security-level analytics (Duration, Convexity, Greeks), and specialized measures like EaR and EvE. Use the feature navigation above to explore each capability in detail.

Vega is not a SaaS provider—we don't host your data. Dolphin-Risk is deployed in your cloud environment (AWS, Azure, Google Cloud) or on-premise infrastructure. Your IT team manages the deployment, and your data never leaves your environment. This gives you complete control over security, compliance, and data sovereignty. We provide subscription-based licensing for the software.

Let us show you how real-time risk analytics can transform how you manage portfolios and serve clients.