Every risk analytics vendor now claims to be “AI-powered.” The demos look smart. But when you actually use these tools, something feels off.

You ask: “Is our VaR too high for this portfolio?”

The AI responds with a generic explanation of what VaR is, or worse, suggests you “check your positions for changes.”

You already knew that. You needed insight, not a definition.

This gap between AI’s impressive demos and its actual usefulness isn’t a technology problem. It’s a context problem.

AI Without Context Is Just an Expensive Search Engine

Think about your best analyst. When you ask them about portfolio risk, they don’t start by defining VaR. They pull up the positions, compare exposures to limits, identify which holdings are driving the risk, and tell you whether to worry.

They can do this because they have context: your portfolio’s positions, your risk limits, your investment strategy. They know your portfolio, not just portfolio theory.

Most AI tools don’t have this context. They’re trained on general knowledge—the Wikipedia version of finance. They can define terms and generate plausible-sounding analysis. But they can’t look at your portfolio and reason about what’s happening.

The Four Levels of Portfolio AI

Not every question requires the same depth. Effective AI for portfolio risk should recognize the difference.

Level 1: Definitions

“What is Value at Risk?”

Any AI can handle this. But your team already knows what VaR means. They need to know what your VaR means. This is where most “AI-powered” tools stop.

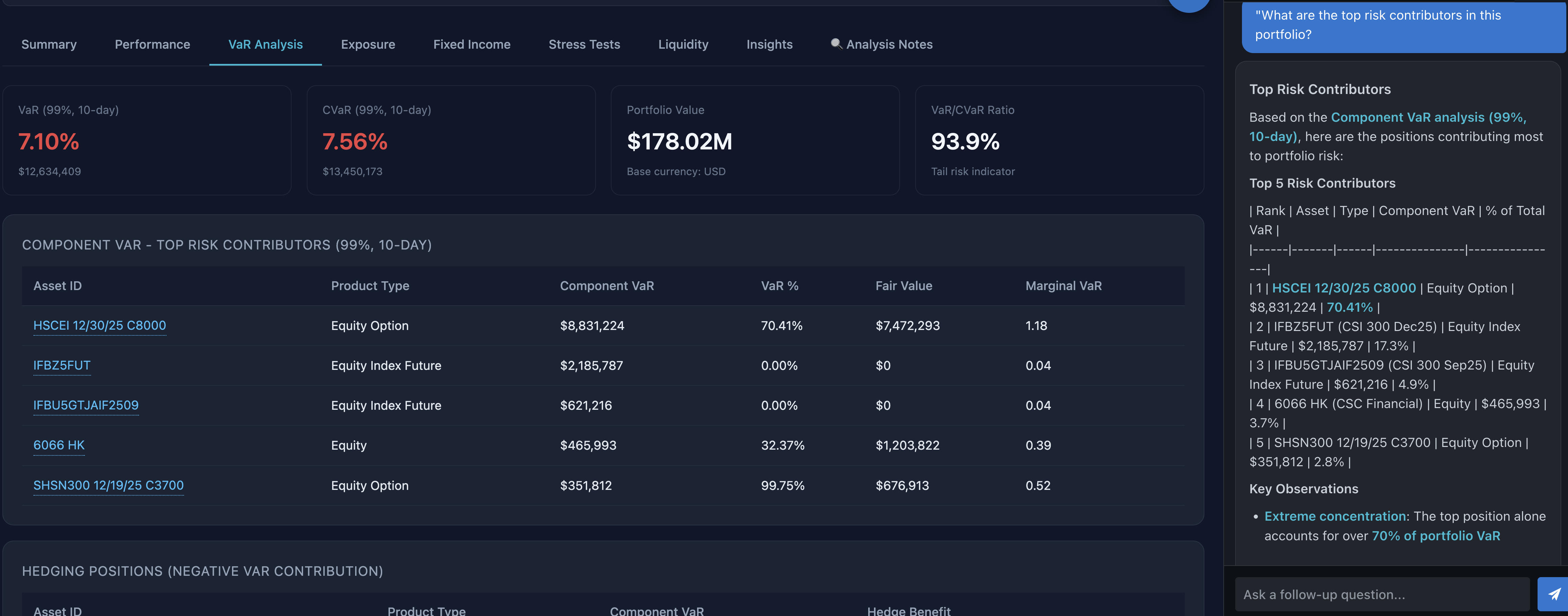

Level 2: Contextual Queries

“What are the top risk contributors in this portfolio?”

This is where context matters. The AI needs to access actual portfolio data—not generate a generic response. Many tools fail here because they don’t have live connections to your risk systems.

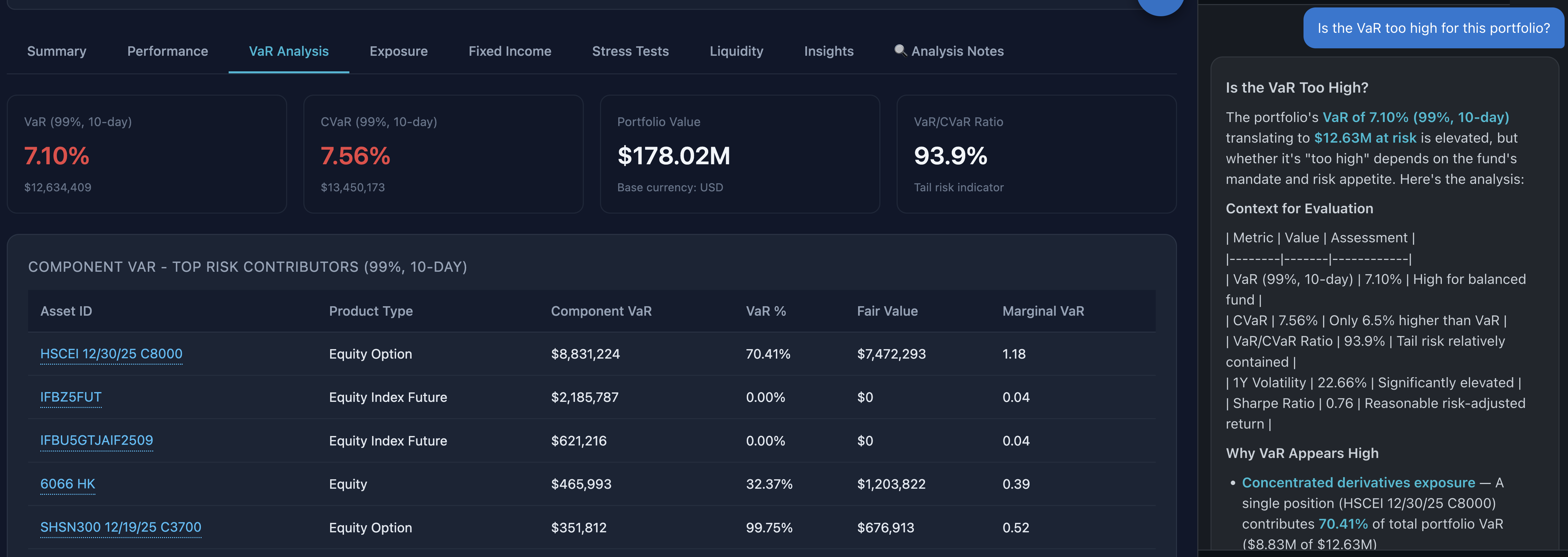

Level 3: Insight Queries

“Is the VaR too high for this portfolio?”

This is where real value emerges. The AI needs to fetch the risk data, evaluate it against limits and context, assess concentration, and explain its reasoning. This requires judgment, not just data retrieval.

Here’s the difference:

Generic AI:

“VaR can be considered high if it exceeds your risk limits. I recommend reviewing your portfolio’s concentration and checking correlation assumptions.”

Technically correct. Completely useless. You already knew that.

Context-aware AI:

Level 4: Advisory Queries

“If I reduce our emerging market exposure by half, how does that change the risk profile?”

This is the frontier—AI that doesn’t just explain what happened, but helps you decide what to do. This requires running what-if scenarios against your actual portfolio, understanding your constraints, and quantifying trade-offs.

We’ve built this capability. The AI runs real simulations using your portfolio data, not theoretical estimates.

What We’ve Learned Building This

The model is the easy part

The hard part isn’t choosing between GPT, Claude, or Llama. It’s giving AI access to the right data in the right format at the right time.

You need specialized tools, not general knowledge

We built over two dozen specialized analytics tools that give AI direct access to specific portfolio calculations—VaR, component risk, stress tests, what-if scenarios, performance attribution. Each tool is designed for a specific type of query.

Transparency matters

Black-box AI isn’t trustworthy for risk management. Our AI shows which data it accessed, what analysis it performed, and how it reached its conclusion. If you can’t verify the work, you can’t trust the answer.

Questions to Ask Any Vendor Claiming “AI-Powered”

Data Access

- Does the AI have direct access to my portfolio data, or do I need to provide it manually?

- Is the data real-time or batch?

- Can it access risk, performance, AND holdings—or just one?

Reasoning

- Can it explain WHY something happened, not just WHAT happened?

- Can it identify which specific positions are driving changes?

Actionability

- Can it run what-if scenarios on my actual portfolio?

- Does it understand my constraints and risk limits?

Transparency

- Can I see what data the AI accessed to reach its conclusion?

- Can I verify the calculations?

- Does it show its reasoning, or just give an answer?

The Bottom Line

“AI-powered” has become a meaningless marketing term. Every vendor claims it. Few deliver it.

Real AI for portfolio risk requires context—direct access to your portfolio data, your risk metrics, your performance history, and your business constraints. Without context, AI is just a sophisticated way to get generic answers.

The firms that will gain competitive advantage aren’t those who adopt AI first. They’re those who adopt AI that actually understands their portfolios.